This accuracy can lead to more informed decision-making by stakeholders, as the financial statements provide a more realistic view of the company’s short-term financial obligations. In particular, note that the closing includes all of the new accounts like purchases, discounts, etc. It may be confusing to see Inventory being debited and credited in the closing process. The answer is that Inventory must be updated to reflect the ending balance on hand. A business should set up its accounting system to timely process, and take advantage of, all reasonable discounts.

Responsibility Centers in Modern Organizational Management

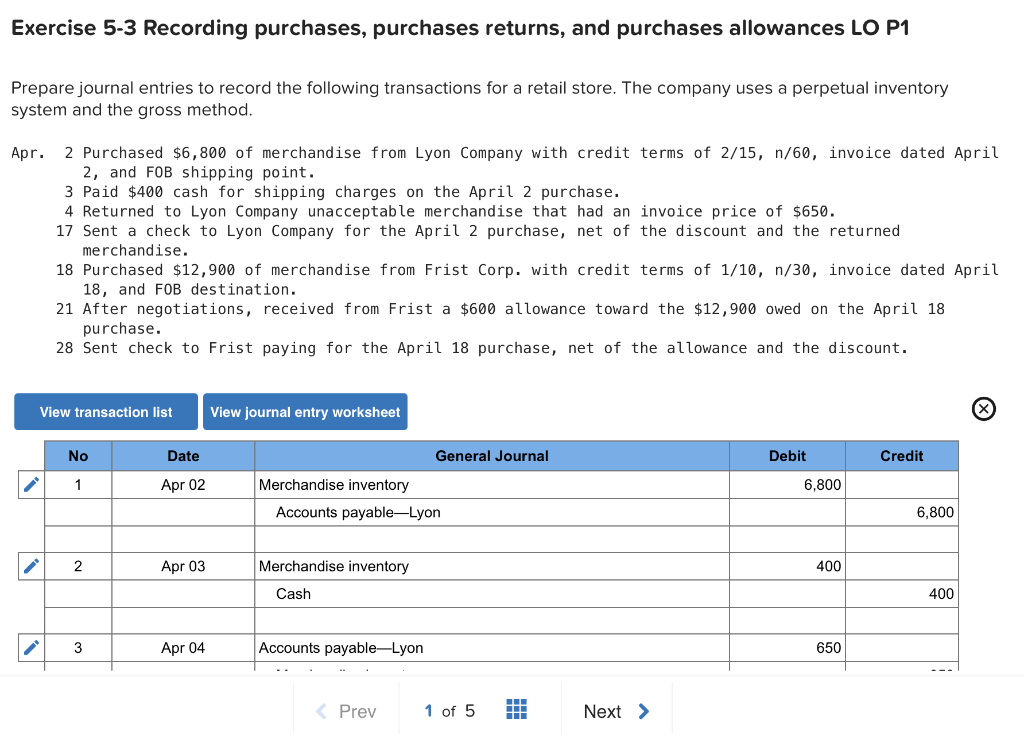

The appropriate accounting for this action requires the recording of the purchase. There are two different techniques for recording the purchase; a periodic system or a perpetual system. Generally, the periodic inventory system is easier to implement but is less robust than the “real-time” tracking available under a perpetual system. Conversely, the perpetual inventory system involves more constant data update and is a far superior business management tool. The following presentation begins with a close examination of the periodic system. Under the net price method, if a company purchases goods for $1,000 with terms 2/10, n/30, the purchase is recorded as $980 ($1,000 less 2% of $1,000).

Applying the Net Method in Financial Accounting

As a result, all income statement accounts with a credit balance must be debited and vice versa. Several items are highlighted in these journal entries and are discussed further in the next paragraph. In evaluating the gross and net methods, notice that the Purchase Discounts Lost account (used only with the net method) indicates the total amount of discounts missed during a particular period.

How Liam Passed His CPA Exams by Tweaking His Study Process

Gross method of cash discount is the accounting method in which sales are accounted for at invoice value and cash discount is separately accounted for when availed by the customer. If the firm does not pay within the discount period, the full invoice price is paid. Imagine a company, “ABC Retail”, purchases inventory worth $1,000 from a supplier. This means ABC Retail can take a 2% discount if they pay the invoice within 10 days, but the full amount is due in 30 days. However, it requires more diligent tracking of payment dates and can make bookkeeping slightly more complicated. A purchase discount is a deduction that a vendor allows on the invoice amount to encourage prompt payment.

- If a company uses the net method, but fails to remit the net amount within the discount period, the net method requires a debit entry to the expense Purchase Discounts Lost.

- The answer is that Inventory must be updated to reflect the ending balance on hand.

- Purchase returns and allowances are subtracted from purchases to calculate the amount of net purchases for a period.

- Sales under this method are thus not recorded at the full invoice value but at the reduced value after considering the effect of cash discount.

For example, if a company records a sale at its net value but later determines that the customer will not pay, it must write off the uncollectible amount. This adjustment ensures that the financial statements accurately reflect the company’s actual financial position. One of the primary advantages of the net method is its ability to streamline the accounting process.

Get in Touch With a Financial Advisor

Lastly, at the time of making payment (failing to get the advantage of cash discount), the journal entry to record the payment under both net and gross method are the same. Under the net method of recording accounts payable, supplier invoices are recorded at the amount that will be paid after any early payment discounts have been applied. This differs from the standard approach, under which the full amount of each supplier invoice is initially recorded, with any early payment discounts recorded only when payment is eventually made. The journal entry to account for purchase discounts is different between the net method vs the gross method. The main drawback to using the net method is that it does not record any information about the discounts taken or when they were taken. In this section, we illustrate the journal entry for the purchase discounts for both net method vs gross method.

The gross method can result in inflated liabilities and revenues on the balance sheet and income statement, respectively, until the discounts are realized. This can create a less accurate picture of a company’s financial health, particularly if discounts are a regular part of its transactions. The need for later adjustments can also complicate financial records, making it more challenging to track and manage transactions over time.

This method reduces the need for subsequent adjustments, which can often clutter financial records and obscure the true financial position of the company. A purchase discount is an offer, from the supplier to the purchaser, to reduce the selling price if payment is made within a certain period of time. For example, a purchaser buying a 100 dollar item with a purchase discount term of 3/10, net 30, will only need to pay 97 dollars if they pay within ten days. Under the gross method, the total cost of purchases are credited to accounts payable first, and discounts realized later if the payments were made in time. And if the payments are not made in time, an anti-revenue account named Purchase Discounts Lost is debited to record the loss. Employers will need to take into account these previous periods of maternity or family related leave or time off sick when calculating the statutory holiday entitlement accrued during subsequent periods.

This means that Barber Shop Supply is responsible for getting the goods to the customer in Dallas. That is why the invoice included $0 for freight; the purchaser was not responsible for the freight cost. Had the terms been F.O.B. Chicago, then Hair Port Landing would have to bear the freight cost. Purchase returns and allowances are subtracted from purchases to calculate the amount of net purchases for a period. The specific calculation of net purchases will be demonstrated after a few more concepts are introduced. The main concern with using the net method arises when a business cannot reliably pay within discount terms.

However, the amount of the entry is for the invoice amount of the purchase, less the anticipated discount. Assuming the company intends to take the discount, this entry results in recording the net anticipated payment into the accounts. Holiday entitlement for these workers will be calculated as 12.07% of actual hours worked in a pay period. The net method what is irs form 8379 recognizes discounts at the point of transaction, impacting a business’s financial statements. By recording purchases and sales at their net amounts, businesses anticipate discounts, reflecting a more precise financial position. This approach encourages companies to take advantage of early payment discounts, fostering financial discipline and efficiency.