Record the purchase discount by debiting the accounts payable account and crediting the purchase discount account. As stock levels arise, and your company grows, the periodic inventory 2020 federal income tax deadline system becomes complex and difficult to manage. That’s why the approach isn’t suitable for every type of company, and the majority of businesses use perpetual inventory instead.

Which Companies Use The System?

Calculate COGs for each line item, and then add them together to get the period’s COGS. Perpetual inventory is the system in which company keeps track of each inventory item level since it was purchase and sold to the customer. The term inventory refers to the raw materials or finished goods that companies have on hand and available for sale. Inventory is commonly held by a business during the normal course of business.

Perpetual LIFO

When you go to the grocery store and scan a box of cereal or a pound of coffee, the computer does in fact record both the sale of the item and the movement of inventory to cost of goods sold. Presumably (if the system is functioning properly and no one is stealing inventory) the accounting records at any moment in time will accurately reflect the stock in hand. Assume at the beginning of the day, there were 10 bags of Starbucks Kona coffee on the shelf and none in the stock room and the store bought those bags for $9 each. At the end of the day, if you check the accounting records, the inventory subsidiary ledger will show two bags at $9 each (cost) for a total of $18. A quick check of the shelf also would reveal two bags of coffee (but not the cost—that’s just in the accounting records). Computers are now doing all those calculations we couldn’t possibly do before, and they are doing them quickly and accurately.

Ask a Financial Professional Any Question

- In the periodic system, the software only updates the general ledger when you enter data after taking a physical count.

- Properly managing inventory can make or break a business, and having insight into your stock is crucial to success.

- The term periodic inventory system refers to a method of inventory valuation for financial reporting purposes in which a physical count of the inventory is performed at specific intervals.

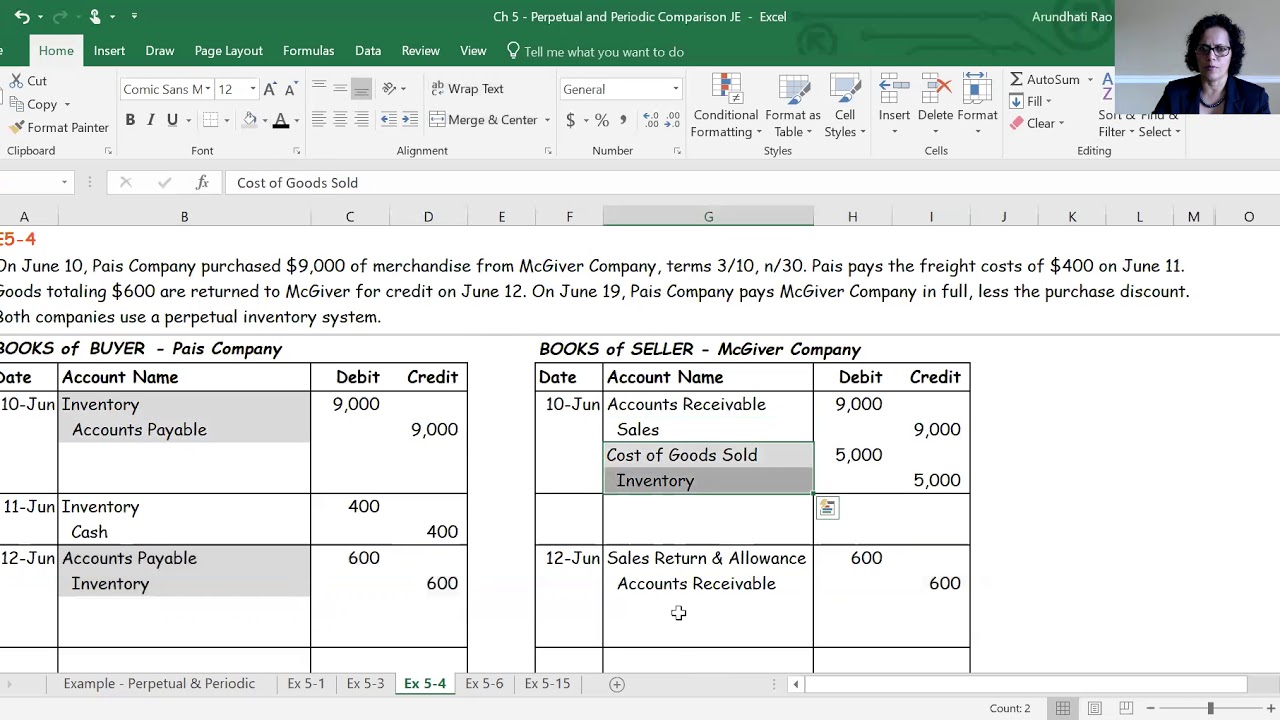

Since some companies carry hundreds, and even thousands of merchandise, performing a physical count can be a tiring and time-consuming process. Under a periodic inventory system, any change in inventory is recorded periodically, typically at the end of the month or year. The debit, merchandise inventory (ending), is subtracted from that total to determine the balancing debit to the cost of goods sold. A small company with a low number of SKUs would use a periodic system when they aren’t concerned about scaling their business over time. Depending on your products and needs, you could also use a periodic system in concert with a perpetual system. The discount is calculated based on the amount owed less the return x 2%.

The concerned department continuously keeps track of the raw materials, the work in progress and the level of finished goods, all three of them being a part of inventory tracking system. Under a periodic inventory system the goods are physically counted, without automatic use of any software of automated counting system. However, during the counting process, the accurate aand updated information of the inventory level will not be present. Although this method requires one less entry, the cost of goods sold is not specifically determined. Once the ending inventory and cost of goods sold are clarified, the accounts require adjustment to reflect the ending inventory balance and the cost of goods sold.

Purchase returns and allowances

On February 28, 2009, Best Buy reported inventory totaling $4.753 billion. However, the company also needs specific information as to the quantity, type, and location of all televisions, cameras, computers, and the like that make up this sum. That is the significance of a perpetual system; it provides the ability to keep track of the various types of merchandise.

This accounting method requires a physical count of inventory at specific times, such as at the end of the quarter or fiscal year. This means that a company using this system tracks the inventory on hand at the beginning and end of that specific accounting period. The inventory isn’t tracked on a regular basis or when sales are executed. The periodic inventory system also allows companies to determine the cost of goods sold. This means the average cost at the time of the sale was $87.50 ([$85 + $87 + $89 + $89] ÷ 4). Because this is a perpetual average, a journal entry must be made at the time of the sale for $87.50.

During the month, people used up (expended) supplies but we didn’t bother accounting for each piece of paper, or even each toner cartridge. In a big business, this account would have so many supplies it would be like accounting for each sip of water an employee took from the fountain. Let’s say you start the month with $250 in the supplies account, based on last month’s ending balance, which was based on a count of the supplies on hand and some assignment of cost to those supplies. Let’s say it was a toner cartridge that cost $200, and five reams of paper that cost $10 each.